Introduction

There can be little doubt that the biopharmaceutical industry is going through a period of unprecedented change. Recognising the dynamic global environment and so as to build on Ireland’s success to date in the sector, IDA Ireland, the national development agency responsible for attracting foreign investment to the country, and a panel of global experts from industry, government, research, and investment communities came together to discuss the future of the biopharmaceutical industry in Ireland.Our aim was to stimulate an engaging discussion with some key learning points and next steps that could be taken to ensure the biopharmaceutical industry continues to thrive here. This whitepaper is the result of that discussion.

We would like to extend our thanks to Darrin Morrissey, CEO of the National Institute for Bioprocessing Research and Training (NIBRT), who chaired the roundtable.

We would also like to thank the following individuals who gave their time to lend their insight to the discussion:

| Susan Abu-Absi Chief Operating Officer (COO) at Be Biopharma |

Henrik Andersen Investment Advisor, Delin Ventures |

Mark Barrett Group CEO & Co-Founder of APC & VLE Therapeutics (The Medicine Accelerator) |

Ger Brophy Chair of Avantor’s Scientific Advisory Board |

| Eamonn Goold Senior Life Sciences Consultant |

Brian Harrison Managing Director of HiTech Health |

Brendan Hughes Board Member, Avantor’s Scientific Advisory Board |

Sinead Keogh Head of Sectors and Director, BioPharmaChem at Ibec |

| John Milne, PhD Director of Training Alliances and Innovation at NIBRT |

Darrin Morrissey CEO of the National Institute for Bioprocessing Research and Training (NIBRT) |

Brian Mullan Pharmacentaur |

Rory Mullen Head of Biopharma and Food at IDA Ireland |

| Graham Symcox Pharmacentaur |

Executive summary

Over the last 65 years, Ireland has become a global centre for biopharmaceutical manufacturing. The initial investments in the 1960s and 1970s focused on the manufacture of small molecule products and through strategic investment and foresight over the past 25 years, Ireland has become a leading hub for biologic medicines and vaccines.The sector continues to grow, attracting over €15 billion in biopharma foreign direct investment in the last decade. There are now around 25 large-scale biologics facilities, complementing the small molecule cluster, with the industry employing over 50,000 people and exporting over €100 billion.

Against this positive backdrop for Ireland as a global leader, the world of biopharma manufacturing is now encountering a period of significant change on various fronts.

- Global supply chains are being evolving by the altering geopolitical picture and economic realities, including changes to global trade environment.

- The pace of innovation in biopharmaceuticals is accelerating. Adding to the well-established classes of protein-based biopharmaceuticals, a range of new therapeutic modalities are being brought through development, including advanced personalised medicines.

- Advanced data science and artificial intelligence are beginning to transform the development, manufacture and commercialisation of medicines and integrated, comprehensive, patient-specific solutions are becoming a reality.

- Increasing numbers of states and countries are prioritising life sciences FDI and investing in incentives and other innovative instruments to attract multinational investment.

Within this fast-changing global landscape, Ireland has to safeguard its competitiveness in biopharma by proactively adapting to these emerging trends and build on its strengths and success.

In mid-2025, IDA Ireland commissioned a strategic roundtable consultation with an expert panel from the industry, government, research, and investment communities. The objective was to critically assess Ireland’s current strengths and identify the strategic development areas and investment initiatives to future-proof the sector.

The roundtable covered subjects such as the transition towards next-generation therapies, manufacturing digitalisation and advanced technologies, developing the talent pipeline, and underpinning Ireland’s innovation ecosystem.

The delegates agreed that Ireland’s biopharma manufacturing base is globally recognised for excellence and is a foundation of significant strength for both the country and for the industry. Within a changing global environment, Ireland can develop and build upon this position of strength by focusing and orienting investment towards the areas that underpin its value proposition:

Ireland stands out as a reliable and resilient global manufacturing hub for biopharma production, leveraging its geopolitical stability, adherence to high regulatory standards, and highly skilled workforce. This makes Ireland an attractive base for firms seeking secure, regionally resilient supply chains in an increasingly volatile world.

| Reinforce Ireland as a stable,resilient global manufacturing hub for biopharma production | Ireland stands out as a reliable hub for biopharma production especially for firms seeking secure, regionally resilient supply chains in a dynamic global environment. Ireland can continue to leverage its geopolitical stability, regulatory track record, and highly skilled workforce to be an ever-reliable, responsive manufacturing base, and especially where firms are looking for secure, regionally resilient supply chains. |

| Make Ireland a global leader in advanced and innovative biopharma manufacturing |

Ireland can build on its small molecule and biologics foundation by investing in the most advanced, agile manufacturing science, process intensification, modularised plants, and “factory of the future” technologies that will offer a differentiated value proposition to accelerate commercialisation for international investors. |

| Firm positioning of Ireland on advanced therapies and next-generation biologics |

Ireland can continue to develop as a centre of excellence for developing breakthrough therapies at scale, such as cell, gene, RNA (ribonucleic acid), and other therapies, by building CMC (Chemistry, Manufacturing, and Controls) capabilities, facilitating small-batch manufacturing, establishing the next-generation manufacturing infrastructure and build on the investment to date in National Institute for Bioprocessing, Research & Training (NIBRT). |

| Use digital and AI to drive biopharma transformation and regulatory innovation |

Ireland can be the pioneer in effective, regulator-compliant use of digital technologies and AI in biopharma through testbeds, attracting world tech leaders, and developing digital and data competence within the manufacturing value chain. |

| Unlock a successful indigenous biotech innovation system with multinational biopharma | With Enterprise Ireland - the government agency responsible for growth and scaling of Irish industry - continuing to bridge funding gaps, and provide entrepreneurial support, Ireland can develop and support a domestic biotech sector scaling out to the world and adding to national innovation capacity with linked multinational anchors. |

| Attain an ambitious, all-of-government national Life Sciences Strategy with European leadership | The Irish government has committed to developing a national Life Sciences Strategy and key stakeholders, including government, industry and academia, have a role in developing a holistic strategy. |

Introduction and background

The history of biopharma manufacturing in IrelandIreland’s first wave of investment in medicines manufacture – in the 1960s and 1970s – was focused on the manufacture of chemically synthesised small molecule products. Many of the operations established during this time, such as Pfizer in Ringaskiddy and Merck in Ballydine, continue to be at the forefront of small molecule manufacturing.

Small molecule manufacturing remains a thriving industry in Ireland, with over 50 plants now manufacturing a variety of Active Pharmaceutical Ingredients (API) and drug products. AstraZeneca is currently establishing a next-generation API manufacturing facility for small molecules in Dublin that will allow for late-stage development and early commercial supply to ensure the company’s global supply network is fit for future growth.

Since the 1960s, the small molecule manufacturing industry has shown continued growth but the development of biologics manufacturing sector as well as services such as clinical trial management and pharmacovigilance activities has increased the size of the industry.

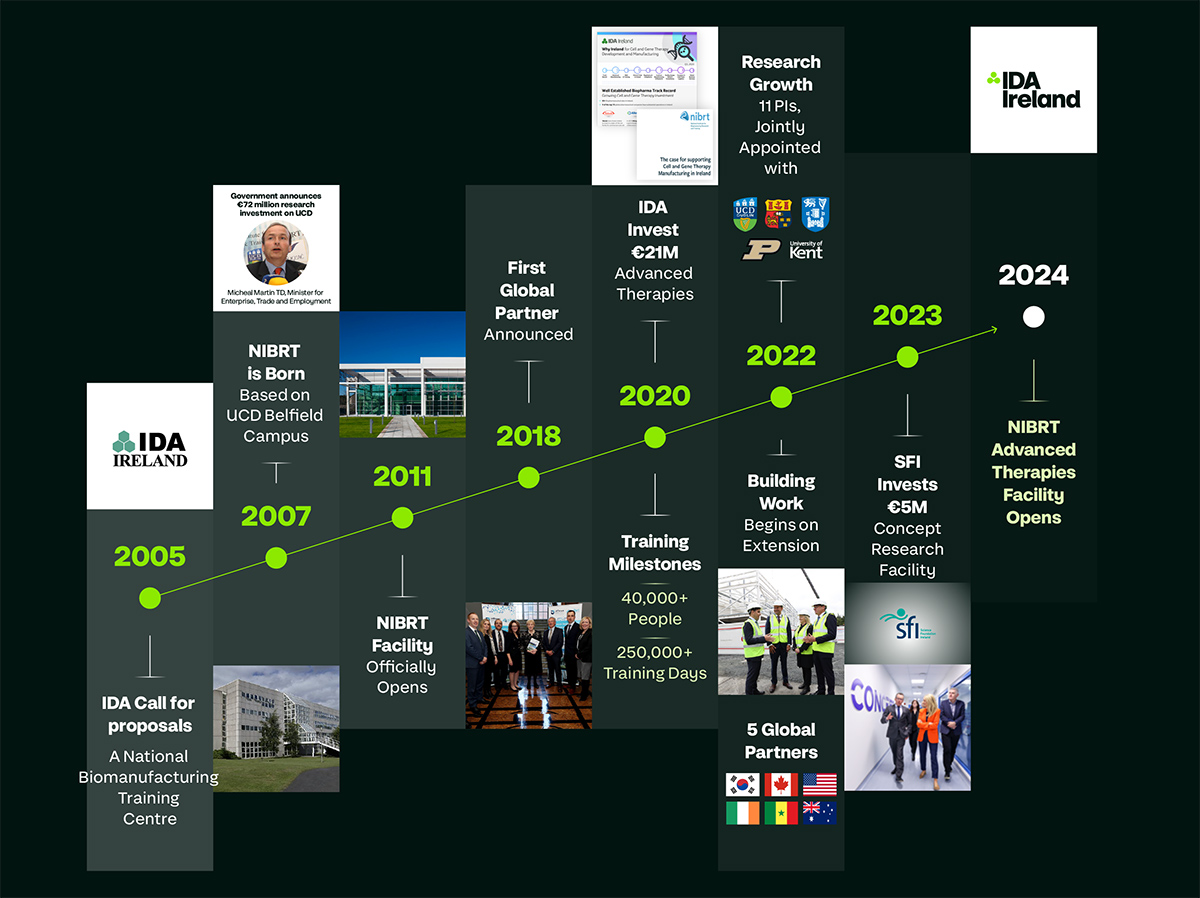

As new modalities of biologics based therapies became more widespread at the start of the century, Ireland actively invested to become an attractive location for these types of facilities including the establishment of NIBRT.

Whilst there had been biologics manufacturing plants in Ireland for many years the growth of the biologics’ manufacturing sector was turbocharged by the announcement in 1996 of the first large-scale monoclonal antibody manufacturing campus in Ireland to be built by the Pennsylvania-based pharmaceuticals company Wyeth, for the manufacture of Enbrel. The complex was completed in 2005 at a cost of €1.5 billion and at the time, was the largest of its kind in the world, employing 1,300 people.

Wyeth’s decision was followed in 2001 when orphan drug manufacturer, Genzyme (2001) invested €400 million in a new site at Waterford for the manufacture of its blockbuster drug Ceradase. In 2004 J&J owned Centocor invested €500 million in a site at Ringaskiddy for the manufacture of their drug Remicade. During this period of remarkable growth in Ireland’s biologics manufacturing sector, in response to the significant investments by major pharmaceutical companies, the country established its NIBRT in the early 2000’s.

The institute was funded by the Irish government through IDA Ireland, with the goal of ensuring a skilled workforce and of advancing scientific research in bioprocessing. NIBRT has since played a crucial role in developing talent and facilitating the biopharmaceutical industry’s expansion in Ireland and has gained international recognition in particular for its top-tier training programmes, state-of-the-art facilities, and pioneering research which have been key to advancing bioprocessing technologies and innovations.

NIBRT 2005-2024: Growth and Evolution

The industry further developed into the next decade. In 2011, Amgen began a $200 million expansion program of its facility in Dun Laoghaire; Biomarin took over Pfizer’s biologics drug substance facility in Ringaskiddy which today employs over 400 people; and Merck built a vaccine plant in Carlow. In 2013, Regeneron moved its European headquarters to Dublin and announced its intention to build a new production and supply centre in Limerick. Manufacture began in 2016 and by 2019 the site employed over 1000 people. In 2016, Shire Pharmaceuticals announced an investment of €400 million in a biopharmaceuticals plant at Dunboyne in County Meath. In 2018, Wuxi Biologics, a Chinese Contract Development and Manufacturing Organisation (CDMO), announced it was investing €325 million in a monoclonal antibody facility

in Dundalk.

Today’s investment climate for biopharmaceuticals in Ireland remains highly favourable. MeiraGTx, a US and UK-headquartered genetic medicine company, recently chose Ireland as its manufacturing site as it looks to scale ahead of moving from clinical to commercial production.

Ireland’s success in both small molecule and biologics manufacturing has solidified its position as a global leader in the pharmaceutical industry. The sector remains dynamic, with significant ongoing expansions and new facilities being established which have been instrumental in growing employment in the biopharmaceutical sector by 20,000 in the last 10 years to over 50,000 today.

Ireland’s

| Ireland’s position of strength in biopharma manufacturing Biopharma manufacturing is now a lynchpin of Ireland’s economy. Ireland has attracted over €15 billion in biopharma foreign direct investment over the last ten years. There are 75 major pharmaceutical plants in Ireland and about a third of these are large-scale biologics manufacturing and aseptic fill and finishing facilities. This robust investment has positioned Ireland as the third-largest exporter of pharmaceuticals globally, with annual exports of over €105 billion, representing over 30% of Ireland’s total exports. |

In recent years, biopharma FDI companies have significantly expanded the scope and depth of their operations in Ireland through smarter and more advanced manufacturing technology and processes etc. Numerous facilities have transitioned from single activity, or single product sites, to multi-functional sites (often including a combination of drug substance production, drug product formulation, and fill/finish operations) for multiple biologic products. There are also an increasing number of facilities that incorporate R&D focused on manufacturing, science and technology (MSAT) activities, including process development/optimisation, scale-up, tech transfer, and process validation. AI is being utilised in both new product introduction and clinical trial management.

Ireland continues to be a stable, secure, and pro-enterprise environment and ranks favourably relative to many competitor jurisdictions as a place to do business. Ireland’s position as an English-speaking gateway to the EU and beyond is attractive to FDI clients, and it is the fastest growing economy in the Eurozone, with sustainably managed public finances and an ‘A’ grade from all major credit rating agencies.2 Ireland also offers attractive EU state aid-compliant grant incentives for biopharma companies to build sustainable facilities in the country, upskill staff, invest in digitalisation and upgrade their operations. This is in addition to stable and competitive corporation tax and recently enhanced R&D Tax credit regime (35%).

Ireland has an enviable record in education and training. With over 60% of Irish people aged 23-34 completing third-level education and the highest proportion of STEM graduates among 20-29-year-olds in the EU, Ireland’s population is highly educated, strongly supporting employment in knowledge-intensive and high-technology sectors.3 Additionally, educators often collaborate with industry and there are increasing opportunities for students and workers to upskill in future skills most relevant to employers. IDA Ireland’s investment in NIBRT provides a unique facility where people can receive Level 6-10 training within a simulated Good Manufacturing Practice (GMP) pilot plant setting.

Over the past 40 years, Ireland has transformed itself into one of Europe’s top ten innovation nations.4 The country is classed as a ‘strong innovator’ Member State in the 2025 European Innovation Scoreboard, which provides an analysis of innovation performance in EU countries, other European countries, and regional neighbours. Ireland also has an established research base in life sciences, with notable global strengths in immunology, genetics, and data analytics. From a pharmaceutical manufacturing perspective, there has been significant state investment over the last 15 years in four large-scale research and development centres: SSPC (S ynthesis & Solid State Pharmaceutical Centre), PMTC (Pharmaceutical Manufacturing Technology Centre), DMI (IDA-funded Digital Manufacturing Ireland), and NIBRT. Each centre has a distinct and complementary focus.

| Synthesis & Solid State Pharmaceutical Centre (SSPC) | The national Research Ireland Centre for Pharmaceuticals, SSPC, is a world-leading hub of Irish research expertise developing innovative technologies to address key challenges facing the pharmaceutical and biopharmaceutical industry. The centre also trains future generations of scientists through postgraduate programmes and research collaborations. |

| Pharmaceutical Manufacturing Training Centre (PMTC) | PMTC is a research centre in Ireland focused on supporting the pharmaceutical manufacturing sector through applied research and innovation. Its focus is on delivering solutions using advanced technology and analytics which address contemporary manufacturing issues impacting on efficiency and sustainability for the pharmaceutical manufacturing sector. |

| Digital Manufacturing Ireland (DMI) |

Digital Manufacturing Ireland is the national body for driving digital transformation in manufacturing. DMI is dedicated to helping Irish manufacturers embrace digital technologies and advance their digital transformation. DMI also supports government objectives by promoting digitalisation and upskilling within the manufacturing sector. |

| National Institute for Bioprocessing Research and Training (NIBRT) |

NIBRT, the national institute for Bioprocessing Research and Training, is a globally recognised institute that provides cutting-edge training and research solutions to support the growth and development of the biopharmaceutical manufacturing industry in Ireland. NIBRT offers a training research experience not previously possible anywhere in the world. |

Ireland’s regulatory environment is very highly regarded on a global scale.5 The national medicines regulator, the Health Products Regulatory Authority (HPRA), is a prominent and well-regarded body within the European Medicines Authority (EMA) regulatory zone. Irish biopharma manufacturing facilities typically perform very well in inspections by global health agencies, reinforcing Ireland’s reputation as a stable and compliant location for medicines manufacturing.

Ireland’s life sciences industry is advantageously positioned near other high-tech, digital-based industries that have attracted large-scale global investments. The presence of multinational corporations (MNCs) and indigenous companies in high-tech sectors such as software engineering and cloud, microelectronics and chip manufacturing, data analytics, high-performance computing, artificial intelligence, and robotics offers excellent opportunities for convergence and partnership activities among leading

companies in Ireland.

The digitalisation of biopharmaceutical manufacturing processes is becoming increasingly prevalent across the entire value chain, presenting an excellent opportunity for Ireland to strengthen its position as a world leader in biomanufacturing.

Evolving global developments

There are now several developments that may disrupt the biopharmaceutical supply chain and require established global biopharma manufacturing locations like Ireland to continue to explore and adapt.

These include:

- Significant uncertainty in the geopolitical landscape and an increased focus by the industry on trusted locations for manufacture of biopharmaceuticals products to enable global supply

- Global trade developments, including the Biosecure Act, are affecting global supply chains as longstanding partnerships are being reassessed.

- FDI competition is becoming increasingly complex and competitive, and that will likely continue

- Increasing pace of innovation in the new therapeutic modalities in development will likely broaden the diversity of manufacturing expertise required

- Increasing use of digital technologies being deployed in the biomanufacturing setting will enable faster speed to market

“The move to simplify the regulatory environment in Europe could enable faster regulatory approvals. Appropriate engagement and resourcing within the EU could generate an advantage here.”

Immediate impacts

The global environment for biopharma manufacturing is evolving worldwide, with major pharmaceutical companies supplying their medicines on a global scale. To maintain its position as a world leader, Ireland can gain a crucial advantage by proactively adapting to these emerging challenges, opportunities, and market dynamics.

Given the length of time and complexity companies are completing the investment plans that are already in train and assessing their future plans for resilient global supply chains.

Rory Mullen, Head of Biopharma and Food at IDA Ireland says:

“In some ways, the current tariff situation is possibly making companies more likely to double down on their regional and other non-US strategies. Given the global patient population Europe will continue to be the home of substantial manufacturing capacity. And that’s where Ireland will continue to compete.”

The new era of supply chain evolution suggests that geopolitical tensions and a clear need for resilience makes it more likely companies will pursue regionally based supply strategies and manufacturing solutions. Ireland is a politically stable and economically aligned partner country for multinational companies looking for secure centres of manufacturing. Furthermore, Ireland has a proven track record as a valuable supply chain link, boasting decades of experience supplying products to patients all over the world.

Companies are global in nature with patients all over the world and require multiple manufacturing and supply chains for resilience and regulatory diversification. There is a clear need for strategic resilience, where Irish facilities become a vital aspect of ensuring supply continuity for rest of world markets and the US.

Ireland’s political and economic stability also offers certainty to biopharma companies, especially when compared with the volatility of the global environment. Furthermore, Ireland’s strategic location and strength in the biopharmaceutical sector position it as an ideal gateway to Asia’s growing markets, offering pharma companies a proven and efficient conduit for expanding supply chains into and from Asia.

In this period of change, Ireland needs to ensure that its value proposition for the manufacture of small molecule, biologics and advanced therapeutics remains competitive and that it continues to be attractive for innovation and other advanced services activities.

Opportunities for growth in Ireland

A stable, consistent and sustainable global destination for biopharma production: sustain and strengthenIreland’s biopharma industry success to date has been one based on geographical centrality, stable and competitive corporation tax, regulatory excellence, and manufacturing skills reliability.

These strengths, in a world of destabilising supply chains and heightened geopolitical tension, are more valuable than ever offering dependability to investing multinational biopharma companies.

Ireland’s position as a strategic supply chain partner for global companies, offering stability and resilience, particularly in the case of geopolitical or trade uncertainty is key. “There’s a whole channel of opportunity around Ireland’s response to global supply chain dynamics,” states Rory Mullen. “There’s a growing need for stable secondary manufacturing sites by multinational companies. Europe will continue to be the residence of manufacturing capacity. These are still attractive to US companies to build their international capacity. That’s where we have strengths.”

Ireland’s well-established reputation for compliance and regulatory professionalism also make it so, with John Milne PhD, Director of Bioprocessing Training Alliances and Innovation at National Institute for Bioprocessing Research and Training (NIBRT) stating:

In terms of workforce development, Ireland has invested significantly in skills and training over the last 20 years, most notably through IDA Ireland’s establishment of NIBRT, as well as increased funding programmes like Skillnet Ireland, Springboard+ and the Human Capital Initiative.“Ireland has an excellent compliance record, which is highly respected by other agencies. One cannot appreciate how important that is.”

Additionally, increased mobility between industries such as MedTech, the food industry, the digital and tech sectors, and biopharma are key. The ability to re-skill and re-train workers in different sectors is key to long-term competitiveness.

As the technology, biopharma and MedTech sectors converge, John Milne says: “There’s a lot more inter-sector mobility than we would ever have imagined that has happened in the biopharma sphere. There are people moving into the biopharma sector, with flexible, dynamic training programmes. Standardising curricula and globalising these programmes can help them further with a broader conversation about capability.”

In the short-term, Ireland can build on its geopolitical stability and good reputation to reinforce its resilience and stability manufacturing from US firms concerned about foreign supply chain risk. Medium-term investment in cross-sector training and national skills standards means that Ireland will remain competitive in the rapidly changing world market. A glimpse into the future sees a clear potential to make Ireland a biopharma centre of sustainable production, not only on the environmental front, but also in building strong, agile operations sensitive to worldwide demand.

Rory Mullen adds:

A whole-of-Government approach is vital to drive progress in the implementation and execution of actions to enhance Ireland’s global competitiveness. National strategies focused on fostering innovation, talent development and supporting sustainable economic growth, already being implemented by Irish government agencies IDA Ireland, Enterprise Ireland (EI), and Research Ireland play a pivotal role in strengthening Ireland’s global competitiveness. Furthermore, Ireland’s Action Plan on competitiveness and Productivity contains policy recommendations to government, ensuring Ireland can adapt to evolving market challenges. Ireland’s value proposition is focused on:There’s uncertainty around how global supply chains will evolve, but one thing that’s clear is our clients are focused on resilient supply chains that can deliver medicines globally. Their mission is to get treatments to patients and being able to deliver drugs to patients all over the world reliably, at scale and competitively.”

- Maintaining and enhancing cost competitiveness.

- Adequately planning for future enterprise growth and implementing an efficient planning and permitting system.

- Ensuring consistent, efficient, delivery of competitive infrastructure.

- Investing in talent development and innovation.

- Enhancing Ireland’s incentive offering (grants and tax).

- Emphasising the importance of sustainability in manufacturing and R&D as the sector embraces Industry 5.0

A leader in new and innovative biopharma manufacturing processes: Diversify and strengthen

Ireland is well positioned to be a global and European hub for the development of manufacturing processes for current and new modalities of medicines with the aims of increasing efficiency, improving product safety, enhancing the scalability of production processes and ultimately reducing costs.

Over the past 20 years, Ireland has developed outstanding capabilities and a global reputation for the efficient, reliable, and compliant manufacture of protein biopharmaceuticals in addition to the small molecule expertise. As well as manufacturing activities, several companies have established process and analytical research facilities on their campuses in Ireland. These companies are increasingly offering lifecycle management capabilities and expertise to their parent companies.

Biopharma manufacturing processes are inherently difficult to standardise and create platforms for, due to the unpredictability and heterogeneity of the biological processes involved. Monoclonal antibody manufacturing has seen big efficiencies improvements over the last 20 years, but with new technologies and innovative deployment, even greater improvements in product yield, safety and overall costs can be achieved. Moreover, next generation biologics and advanced therapies – including antibody-drug conjugates (ADCs), radio-labelled antibodies, bi and tri specifics antibodies and cell and gene-based therapies - still require significant work to improve the efficiency and viability of their manufacturing processes.

A world leading centre of excellence for manufacturing and development of advanced therapies and next generation biologics: Diversify and transform

Over 1,000 advanced therapies and next-generation biologics are in clinical development. Highly complex and expensive manufacturing processes and distribution models coupled with narrow low volume indications, currently limit the scalability and economic viability of these products. Ireland has the capability to establish itself as a location of choice for CMC research activity that addresses these manufacturability challenges and establishes new advanced therapy manufacturing standards.

As Graham Symcox of Pharmacentaur says:

Ireland is already globally recognised as a world leader in biopharmaceutical manufacturing and certainly has the right ingredients available to be a lead player in advanced and next-generation therapeutics.“Companies are streamlining internal technical capability, and they still need to make complex manufacturing changes for improved efficiency. Ireland can fill that gap as a CMC and regulatory services centre of trained people and facilities to deliver.”

As cell and gene therapies (CGTs), RNA-based therapies, and innovative biologics, like ADCs and radiolabelled monoclonals, transition from the proof-of-concept phase to scale up and commercialisation, countries with mature regulatory frameworks, a well-developed biomanufacturing sector and manufacturing research and process development expertise will play a strong role in their success.Henrik Andersen, Investment Advisor Delin Ventures, says:

But Ireland’s established life sciences cluster is underpinned by a vibrant and dynamic ecosystem that combines a highly skilled workforce, deep strengths in process development and regulatory landscape, a thriving CDMO sector as well as a collaborative culture to drive innovation in the biopharmaceutical sector. Supported by the government through its agencies such as IDA Ireland, Enterprise Ireland and Research Ireland, the sector is further bolstered by NIBRT and a offers a solid foundation on which to compete on quality, compliance, and efficiency for this exciting next generation of products.“Ireland’s biopharma industry certainly has the potential to be a hub of excellence in this new environment. Globally, over 1,000 cell, gene, and other next-generation therapies are at different stages of clinical development. Of these, roughly 40% are being developed by US-based biotech and biopharma companies, 40% by Asian companies (most prominently China) and 20% by in Europe-based companies. This is both a measure of the scale of opportunity and of the competitive challenge that Ireland has to consider and overcome”

Ireland’s successful attraction of biopharma foreign direct investment over the past two decades has built a world-class foundation of GMP-compliance, infrastructure, highly-skilled professionals, and a track record of operational excellence. More recently, companies such as MeiraGTX have begun evolving Ireland’s capability beyond conventional biologics, into advanced therapy manufacturing.

| MeiraGTx MeiraGTx is a vertically integrated, clinical stage gene therapy company founded in 2015. The company focuses on developing potential curative treatments for patients living with serious genetic diseases of the central nervous system, eye and salivary gland. In 2020, MeiraGTx set up its first production facility in Ireland. The facility, a 150,000 sq ft site at Shannon in the Midwest of the country, was the first commercial-scale gene therapy manufacturing site in Ireland, unique in its scale and integrated capabilities. This internal manufacturing capability removed a key obstacle in the supply chain which can add significant costs in gene therapy manufacturing supply. In doing so, it helped MeiraGTx accelerate the development and delivery of gene therapy treatments to patients facing a wide range of both genetic and non-hereditary disorders. |

The next phase of this evolution is critical. Next-generation treatments, particularly cell and gene therapies, are characterised by scientific and operational complexities – e.g. cold chain supply, regulatory complexity, batch-to-batch variability, and customised manufacturing - that demand levels of precision and flexibility that drives up the cost of manufacturing. Chimeric Antigen Receptor T-cell (CAR-T) therapy, for instance, delivers significant clinical benefits for a sizeable proportion of patients treated but still far too costly for society and individuals to bear, currently ranging from €300,000 to €500,000

per treatment.

Efficiency improvements in decentralised manufacturing models are being explored across the industry and are reducing the cost of these treatments, at least in principle. Substantial innovation is coming from the US and China, in overcoming cost and scalability challenges, with earlier bottlenecks like viral vector manufacturing becoming more tractable with new technical competencies. NIBRT’s recent advanced therapies expansion is driving Ireland’s development in this area but there is more to do to develop the sustainable manufacturing standards of the future.

Additionally, with the current licenced diseases for advanced therapies typically in low volume niche markets, there is an underlying issue around the availability of manufacturing facilities and services, which are reserved for large-volume therapy manufacturing. Susan Abu-Absi, COO of Be Biopharma says: “We’re seeing companies with small-volume advanced therapies struggling to find manufacturing partners. Ireland has a real opportunity here, if Ireland can meet them where they are.”

She adds:

There are several emerging opportunities where Ireland is staking a claim around the development and deployment of these facilitation technologies for advanced therapies. Investment in the production of viral vectors and plasmids, areas where Ireland is already established, allows the country to play to its strengths and address global demand in these key enabling elements. Additionally, Ireland promotes small-volume manufacturing to build on the existing CDMO capabilities in the country, either by FDI or indigenous companies. Also, the trend toward decentralised manufacture further enhances a potential case for Ireland to take a lead on mobilising modular platforms, maximising responsiveness and making closer-to-patient delivery more accessible.“We need to support small-batch advanced therapies. Companies assume they’ll be able to outsource, but in many cases, the volumes are so small they’re forced to do it themselves.”

It’s also worth noting that the current CGT market is highly specialised and in effect operates in low volume niche markets including haematological cancers and genetic-based conditions. Ongoing trials are developing therapy platforms for deployment in larger scale clinical indications – e.g. the use of engineered B-cells for the treatment of autoimmune diseases – which would result in much larger global market sizes and necessitate more that the cost of manufacturing is addressed.

Ireland has invested in advanced therapeutics through the €20 million expansion of NIBRT’s cell and gene capabilities.

Ireland is focused on this longer-term opportunity, making investments up front so it’s ready for when this growth comes. Henrik Andersen says: “Ireland continues to help its existing installed base companies make the pitch to win advanced therapy investments - that means adding flexible capacity, not just expanding old assets.”

At the heart of Ireland’s competitiveness is its agile, highly skilled workforce and a strong culture of cross-functional collaboration. Combined with deep strengths in process development, automation, and compliance, Ireland is well positioned to create scalable, cost-effective, and regulatory-compliant solutions for even the most complex therapies.

The future of next-generation medicines will demand flexibility, vision, and strategic investment. With concerted action, especially in infrastructure, talent, and public-private partnership, Ireland can partner with global leaders in the testing, development, and production of advanced therapies, delivering economic value and life-saving innovation to the world.

A global centre where the power digital and AI delivers value for biopharma: Diversify and transform

Biopharma 4.0 is now reality. But the biopharma industry still struggles to define its needs. On one hand, it is clear that digital, data analytics and AI-enabled process improvement can yield manufacturing efficiencies and cost savings. While on the other hand long-term digital and AI transformation, with the potential for short-term disruption of the highly-regulated GMP environment, may unsettle the industry. Ireland is a supportive environment where widespread use of digital technologies and AI in biomanufacturing can be road-tested and de-risked in partnership with regulators in Ireland and overseas, including the EMA and FDA.

Digital, data, and AI-driven solutions continue to penetrate the life sciences sector. Today, most biopharma companies are focusing on two aspects: reducing near-term operational costs and laying the ground for longer-term transformation. Ger Brophy, Chair of Avantor’s Scientific Advisory Board, noted that short-term traction with digital and AI technologies will likely be achieved in the “low-hanging fruit” in areas such as going paperless, streamlining corrective and preventive actions (CAPA), deviation management and supply chain optimisation.

Brophy cautions that in biopharma a balance needs to be struck between transformation and disruption. In a highly regulated industry like biopharma, radical revolution creates risk and resistance. Transformation is key, but it must be well planned and staged. “The industry is very sensitive about being overly disruptive,” Brophy warns.

Ireland is developing the right skills, driving strategic adoption of digital competences and helping the industry to manage the delicate balance between innovation, operational stability and regulatory necessities.

Brendan Hughes observes that digital literacy and core capability in AI and data should become a strategic priority for Ireland’s biopharma sector. “The industry badly needs to get more digitally literate,” he underscored. Ireland can enable biopharma manufacturing companies to leverage decades of operational data, data that is all too frequently underleveraged, through more effective automation strategies.

One of the most critical actions in this endeavour is to help firms get their data into a usable form that can enable AI applications that can in turn inform faster, better decision-making.

Concepts such as data inheritance and data genealogy which provide a formal view of how data flow through manufacturing systems, may help convert static data into actionable intelligence. Hughes further pointed out that increased connections between biopharma and tech could accelerate meaningful innovation.

In the view of industry, however, innovation cannot proceed without engagement and collaboration with the regulators. Ireland in partnership with regulators and in a collaborative manner can accelerate the adoption of digital and AI in biomanufacturing.

To that end, Ireland should continue to invest in innovation across the biopharma sector which will build on earlier advancements, consolidate past investment, de-risk innovation, drive progress and position Ireland at the vanguard of next-generation manufacturing enablement.

One leading discussant says,

“With biopharma you have to flip your thinking. Biopharma is not like tech or discrete manufacturing. It starts with the patient – whereby we have to ensure drug efficacy and safety - and we work our way back. The whole manufacturing system and supply chain must be designed around that.”

A thriving indigenous biotech ecosystem sitting alongside biopharma manufacturing: Diversify and transform

Unlocking the full potential of Ireland’s biopharma and biotechnology sector will require renewed emphasis on supporting the growth of local biotechnology companies capable of scaling internationally. Ireland’s life sciences sector is primed for global leadership, blending world-class manufacturing with a dynamic ecosystem in biotechnology and biopharma innovation.

Whilst the industry is characterised by leading multinational companies, there are opportunities to further nurture Irish indigenous biotech start-ups and scale-ups. Sinead Keogh, Head of Sectors and Director of BioPharmaChem at Ibec, underscores the importance of building a balanced system where indigenous Irish companies can thrive alongside multinationals. “We also want to creative more indigenous businesses with global aspirations,” Keogh notes. Drawing lessons from the Irish MedTech sector’s targeted supports and entrepreneurial culture, she adds:

In an era of unprecedented demands for pioneering innovations, Irish-owned companies are delivering solutions to tackle global healthcare challenges. From improving patient outcomes to transforming the delivery of healthcare, Irish life sciences companies are trusted by many. Indeed, Enterprise Ireland aims to have 150 Irish companies with market capitalisations of more than €1 billion by the end of the decade.“The ethos of developing a balanced system where Irish-owned companies can compete on an equal basis with multinationals globally, is one that we should also aim for in biopharma and biotech.”

Future development of the sector will also benefit from continued targeted support, strategic infrastructure investment and fostering a culture of entrepreneurship. In particular, industry leaders highlight a unique opportunity to bridge the gap between research and commercialisation. Mark Barrett, Group CEO & Co-Founder of APC & VLE Therapeutics expresses the view that: “Right now, there’s a major gap between early-stage research funding and enterprise-scale investment in Ireland.” He advocates that Ireland “make the funding ecosystem more integrated, with different elements strategically aligned and ‘talking to’ each other.

Creating a more integrated funding environment that aligns public and private investment, encourages tax reform and supports accelerator initiatives, Ireland can further empower early-stage biotech companies and smaller multinationals to thrive. Brian Harrison of HiTech Health points to the value of strategic investment in accelerator infrastructure, stating:

Together these perspectives highlight a clear opportunity for Ireland to cultivate a world-class, innovation-driven life sciences sector.“The idea of a biopharma accelerator is about building national capability, infrastructure, skills and services all in one place.”

Shaping EU and national policy to drive growth

Ireland stands at a critical point in its life sciences journey. Having gained a worldwide reputation as a manufacturing location for chemical and biological pharmaceuticals, Ireland can now set a clear, shared vision for the next stage, driven by innovation and leading-edge therapeutics.

Darrin Morrissey, CEO of NIBRT, says:

The development of the national Life Sciences Strategy for Ireland is an opportunity for Ireland to play a key role in the development and delivery of the European Life Sciences and Industrial policies.“We have a huge opportunity within our grasp. Working with industry and our EU partners, Ireland must continue to advocate for a strong biopharma manufacturing and biotechnology start-up agenda at the centre of European industrial policy.”

This integrated effort would also position Ireland to shape and inform, not simply track, EU-level policy trends, particularly with medicines supply sustainability, biopharma and medtech manufacturing and the biotec agendas that are expected to ramp up across Europe in the next 1-2 years.

Europe’s competitiveness and capacity for innovation and company creation has been widely reported in recent years. Ireland’s biopharma future is not just about production but also positioning, policy and presence. With a unified national strategy and partnership in Europe, Ireland can shape the next wave of life sciences innovation.

Conclusion

Ireland’s evolution during the 1960s from a small molecule foundation of manufacturing to the globe’s premier biologics and biopharmaceutical manufacturing powerhouse that it is today stands testament to vision, strategic investment, and the evolution of the industry which has been enabled by strong partnership with government.With more than €15 billion in foreign direct investment in biopharma over the past decade, the employment of more than 50,000 people, and exports of more than €100 billion, Ireland ranks among the world’s top life sciences manufacturing hubs. The next instalment in this success story will not be penned on the foundation of yesterday’s victories; it will be borne out through bold, wise and strategic action in an era of disruption and opportunity.

Biopharma globally faces tectonic shifts: geopolitical alignments, new therapeutic possibilities like cell and gene therapies, the growing integration of digital and AI, and fierce international competition for investment and talent. Ireland’s strategy is one of duality - maintaining what it has already built whilst harnessing new thinking to strengthen and build a diversified, innovation-based ecosystem that supports future biopharma growth.

This requires sustained action on six interconnected fronts. Ireland should:

- Enhance its value proposition as a strong, stable, and responsive global manufacturing platform, supporting geographically resilient multinational company supply chains.

- Lead the adoption of advanced and complex manufacturing processes, creating “factory of the future” proficiencies combining technical competence, digital control, and modular flexibility.

- Establish a leadership role in next-generation therapy development and commercialisation, from viral vectors to decentralised cell and gene therapy models and offer world-class CMC and MSAT capability.

- Leverage its robust digital and tech base to become a global centre for biopharma digital transformation, spearheading regulator-aligned AI and data integration.

- Develop an active start-up and scale-up ecosystem for domestic biotech, filling current funding, and capability gaps to spur indigenous innovation in parallel with multinational anchors.

Ireland’s biopharma future will be marked by leadership, collaboration, and innovation. With decisive, collective action, Ireland can use its excellent foundation to shape the future of global biopharma, create high-value employment, drive sustainable economic growth, and deliver life-saving medicines to patients around the world.